CHAPTER 18: Capstone Project - Personal Budgeter

The Competitive Edge for Modern Project Managers

Introduction to Capstone Project - Personal Budgeter

This capstone turns Agile theory into a concrete, end-to-end example. You will see how roles, events, and artifacts work together on a real product. We bridge the gap between concepts and practice by walking from vision to release. By following a complete lifecycle, you can connect planning, execution, and learning in one flow. This mirrors the intent of the original capstone overview, adapted to our new product.

Purpose of the Capstone Project

The goal is to model Scrum in action, step by step, for a real app. You will watch how deliverables are created, inspected, and adapted during Sprints. You will observe planning that promotes transparency and value delivery. You will also see how the framework turns feedback into decisions. The experience shows how separate ideas form a single, repeatable Agile workflow for product delivery.

What We Will Build

Our product is a Personal Budgeter App. It helps users categorize income and expenses, set savings goals, and track cash flow. Planned features include budgets by category, smart rules, goal tracking, and visual reports. We may add receipt capture, basic bank import stubs, and gentle overspend alerts. The scope is simple to follow, yet rich enough for a meaningful backlog and multiple Sprints.

How to Approach This Section

Treat this as a guided simulation of Scrum. You will see a product vision tied to objectives, a backlog with epics, features, and user stories, and time-boxed planning that readies the team for Sprint work. You will also see risk management, progress tracking, and retrospectives in action. Your task is to observe, reflect, and connect these activities to earlier lessons.

Key Takeaway

You already know the principles. Now you will apply them to a working budget app. By completing this chapter, you will understand how to move from ideas to incremental releases. You will see how theory becomes practice through short cycles and clear artifacts. This experience builds confidence to run or join Agile projects in your own context.

Setting the Stage

Product Context and Vision

Every meaningful initiative begins with context. Our Personal Budgeter App exists to help everyday people take control of money. It simplifies tracking income and expenses, clarifies habits, and supports informed choices. The vision is to make budgeting approachable and routine. People should see where money goes, set goals with confidence, and feel progress weekly. The product fits a crowded market, yet differentiates through clarity, empathy, and steady improvements based on genuine user feedback.

Core Values

Values shape decisions and tradeoffs. Simplicity ensures the app remains easy to start and effortless to maintain. Transparency makes data, assumptions, and calculations clear at every step. Privacy protects sensitive financial information as a top priority. Inclusivity welcomes diverse financial situations without judgment. Continuous improvement drives small, thoughtful enhancements that reduce friction. These values guide design, prioritization, and ways of working. They steer conversations when choices conflict, and keep the team aligned under pressure.

Strategic Objectives

Objectives translate vision into targets. Grow active users through an intuitive onboarding that reaches first value in minutes. Improve retention by turning weekly check-ins into a friendly habit. Increase goal attainment by simplifying savings flows and progress visualization. Reduce support needs by detecting common errors early and explaining fixes in plain language. Enable responsible monetization that respects trust and privacy. These objectives shape roadmaps and help evaluate features. They also make success measurable and visible.

| Company Name | ClarityBudget Inc. |

|---|---|

| Company Vision | Help every household feel in control of money, with clear guidance, gentle habits, and stress-free budgeting. |

| Company Mission | Design a friendly budgeting companion that simplifies tracking, reveals patterns, and turns goals into weekly progress. |

| Core Values |

|

| Strategic Objectives (3–5 years) |

|

Problem Statement

Many people want control of their money, yet budgeting often feels exhausting. Tools can be complex, judgmental, or too manual to sustain. Our app aims to reduce cognitive load, not add to it. The problem is clear. How might we help users capture spending quickly, understand patterns, and nudge better choices without overwhelm. The solution must fit into busy days, work well on mobile, and deliver value even with partial data. Small wins should appear early.

| Background | ClarityBudget Inc. aims to help households feel in control of money. The vision is a friendly companion that simplifies tracking, reveals patterns, and turns goals into weekly progress. Strategic objectives include strong retention through helpful habits, responsible monetization, and high trust through privacy and transparency. |

|---|---|

| Current Situation | Many budgeting tools feel complex, judgmental, or time consuming. People abandon them after a few weeks. Manual entry is slow, categories are confusing, and reports are hard to understand. Users need fast capture, clear insights, and guidance that fits busy lives. |

| Problem | Households lack a simple, compassionate way to track spending, understand patterns, and make better choices. Existing solutions add friction, increase cognitive load, and fail to build sustainable habits. This gap prevents users from maintaining budgets and reaching savings goals. |

| Opportunity |

|

| Key Question | How can ClarityBudget Inc. deliver a simple, humane budgeting experience that builds lasting habits, reveals useful insights, and helps households reach their financial goals while protecting privacy? |

Stakeholders and Business Roles

Strong sponsorship and clear ownership enable momentum. An executive sponsor champions outcomes and ensures alignment with the organization’s strategy. A product owner curates the backlog to maximize value, and sets clear release goals. A compliance advisor interprets regulations and guides acceptable designs. A data security lead safeguards privacy and architecture decisions. Customer support brings real-world insights to prioritize pain points. Finance and marketing ensure the business model is fair, sustainable, and trustworthy.

Delivery Team

Delivery depends on a cross-functional team. A scrum master supports flow, facilitates events, and removes impediments. Designers craft journeys and interfaces that reduce effort and confusion. Mobile and web developers deliver features with reliability and performance in mind. A quality specialist builds tests that protect critical paths, such as category rules and monthly rollovers. A data engineer ensures reports are accurate and fast. Everyone collaborates, shares context, and owns outcomes together through increments.

| Name | Role | Responsibilities | Interest | Notes |

|---|---|---|---|---|

| Eva | Executive Sponsor | Sets outcomes, secures funding, aligns the app with company strategy. | High | Escalation path, quarterly checkpoints. |

| Liam | Product Owner | Owns vision, prioritizes backlog, defines release goals and acceptance criteria. | High | Voice of users, value first. |

| Maya | Scrum Master | Facilitates events, removes impediments, supports continuous improvement. | High | Focus on flow and transparency. |

| Jonah | UX Researcher | Runs interviews, maps journeys, validates habits and usability. | Medium | Early discovery and weekly tests. |

| Sophia | Product Designer | Creates information architecture, designs interfaces, hands off specs. | High | Mobile first, clear copy. |

| Ethan | Mobile Developer | Builds iOS and Android features, ensures performance and reliability. | High | Owns offline queue and sync. |

| Nora | Web Developer | Delivers responsive web app, supports onboarding and dashboards. | Medium | Parity with mobile where sensible. |

| Arjun | Backend Engineer | Designs APIs, handles data models, manages encryption and storage. | High | Zero trust mindset. |

| Zoe | Data Analyst | Builds cash flow reports, defines metrics, validates analytics events. | Medium | Privacy by default for all data. |

| Marco | QA Specialist | Automates tests, verifies acceptance criteria, guards critical paths. | High | Focus on rollovers and goals. |

| Layla | Security Lead | Reviews designs, manages secrets, runs threat modeling and audits. | High | Compliance ready, minimal data. |

| Grace | Compliance Advisor | Interprets regulations, approves data handling and retention policies. | Medium | Regional rules and disclosures. |

| Omar | Customer Support Lead | Surfaces pain points, drafts guides, closes the feedback loop. | Medium | Monitors first-month churn drivers. |

| Chloe | Marketing Manager | Defines positioning, runs experiments, measures activation and retention. | Medium | Ethical messaging, no fear tactics. |

| Alex | Finance Partner | Models pricing, tracks unit economics, ensures sustainable monetization. | Low | Prefers transparent fee structures. |

| Beta Circle | User Representatives | Provide feedback on goals, categories, and reminders, report friction. | High | Diverse segments, monthly panels. |

Initial Constraints and Assumptions

Constraints focus choices. The launch must support modern mobile platforms and a responsive web experience. The first release will prioritize manual entry and import stubs, not full bank integrations. Sensitive data will remain encrypted, with minimal collection by default. Notifications and alerts will avoid nudging during quiet hours. We assume users will accept light categorization rules, and appreciate smart defaults. We also assume offline behavior should queue gracefully, with sync that preserves user intent.

Target Users and Needs

Primary users track everyday budgets across categories like housing, food, transport, and savings. They want fast entry, clear summaries, and forgiving corrections. They prefer helpful suggestions over rigid rules. Secondary users include partners who share budgets, or caregivers managing household finances. They need visibility without confusion. Everyone benefits from goal tracking that connects to real actions, such as moving money to savings. Trust grows when the app respects privacy and explains recommendations plainly.

Scope Boundaries for Early Releases

Clear boundaries prevent overreach. Early releases will include category setup, quick-add transactions, recurring expense templates, and monthly rollovers. Simple goals will track progress toward savings targets. Cash flow views will show trends for the last ninety days. Receipt capture will be limited to storing images, with later text extraction. Bank imports will begin as structured stubs, not live connections. Advanced forecasting, investment tracking, and complex tax features sit outside the initial scope.

Measures of Success

Outcomes matter more than output. Time to first budget should be under ten minutes. A majority of new users should complete a first month with at least three weekly check-ins. Goal creation should feel natural, with many users setting at least one goal within their first week. Support contacts should decline as guidance improves. Privacy trust indicators should remain high. These measures inform priorities, guide retrospectives, and shape what gets released next.

Risks and Early Mitigations

Risks demand early attention. Complex data models can slow delivery, so we start simple and refactor incrementally. Privacy mistakes can destroy trust, so we apply least-privilege access and thorough reviews. Feature creep can dilute value, so the product owner guards scope with clear success criteria. Low engagement can erode momentum, so we focus on habit loops and thoughtful reminders. Integration delays can stall progress, so we treat imports as asynchronous stubs at first.

From Context to Backlog

With vision, values, objectives, and constraints defined, the team can craft a focused backlog. Work will center on onboarding, categorization, goals, recurring expenses, and cash flow views. The product owner will shape thin slices that deliver visible benefits. The team will release small increments that reduce friction and reveal insights. Feedback will refine decisions. This foundation sets expectations, reduces uncertainty, and allows steady progress toward a budgeting tool people enjoy using daily.

Initiating the Agile Project

Vision Statement

The Personal Budgeter App exists to help everyday people feel calm and confident with money. It turns scattered transactions into clear stories, and turns goals into steady progress. The vision is a friendly companion that reduces effort, celebrates small wins, and respects privacy. Every decision should move users closer to financial clarity. Every release should reduce friction, reveal insight, or strengthen trust. This product sets a north star for the team, and guides choices when tradeoffs arise.

Target Users

The primary audience includes busy households that want a simple way to manage spending. They value quick capture, clear categories, and honest guidance. New budgeters seek momentum without shame. Experienced budgeters want speed and smarter suggestions. Secondary users include partners who share budgets and caregivers supporting family finances. They need visibility that is simple, not overwhelming. Clear targeting helps the team focus. It shapes priorities, copy, and onboarding flows, and informs which features must arrive first.

Key Features

The core experience centers on swift entry and clear feedback. The initial feature set includes category setup with helpful defaults, quick-add transactions, and recurring expense templates. Goal tracking converts intentions into weekly actions. Cash flow views show where money goes across time. Import stubs allow simple upload of bank files without live connections. Gentle alerts nudge check-ins and celebrate progress. These features create a complete path from capture to insight, while keeping effort low and predictable.

Value to the Business

The app supports growth through practical value that users feel weekly. Retention improves as people build check-in habits and reach goals. Responsible monetization arrives through optional premium coaching and advanced reports, not through intrusive tactics. Privacy and transparency protect brand trust, which lowers acquisition costs over time. Continuous improvement provides a steady cadence of small wins that sustain engagement. By aligning product choices with trust and usefulness, the business earns durable relationships, not short-term spikes.

Value to the Users

Users gain peace of mind through clarity and routine. They can see spending patterns, adjust categories, and align daily choices with goals. The app reduces cognitive load by automating repetitive work and explaining calculations in plain language. Progress is visible and motivating. Mistakes are easy to fix without embarrassment. People can invite a partner to view shared budgets without confusion. Over time, small improvements add up. The result is steadier decisions, fewer surprises, and more confidence.

| Vision Statement | The Personal Budgeter App turns everyday money decisions into calm, confident habits. It simplifies tracking, reveals patterns, and celebrates progress. The product helps households see where money goes, set achievable goals, and stay on track each week. Privacy and clarity guide every choice. The experience is friendly, fast, and judgment free. |

|---|---|

| Target Users |

|

| Key Features |

|

| Value to the Business |

|

| Value to the Users |

|

Crafting an Elevator Speech

The elevator speech condenses purpose into a short, memorable message. It should be simple, specific, and inspiring. It must connect the customer pain to the value we deliver. It should reflect our values of simplicity, privacy, and empathy. This single message aligns executives, designers, and engineers. It also guides onboarding copy and marketing headlines. When choices compete, we revisit the speech. If a feature does not strengthen the promise, we tune it or defer it.

Elevator Statement: Personal Budgeter App

“Everyone deserves calm, confident money management. The Personal Budgeter App makes budgeting simple, fast, and judgment free. Capture spending in seconds, set goals that fit real life, and watch progress each week. Clear cash flow views and gentle reminders keep you on track. Privacy comes first, and your data works for you. Turn confusion into clarity, and turn plans into steady results.”

Why the Elevator Speech Matters

A tight message creates alignment across all stakeholders. Executives hear the business value. Team members hear the user promise. Users hear a friendly, trustworthy partner. The speech anchors product reviews, release notes, and demos. It keeps roadmaps focused and backlogs clean. It helps avoid drift when new ideas appear. By repeating the message in rituals, the team remembers why the product exists. That memory shapes choices when time and budget are tight.

Elevator Statement:

The Personal Budgeter App turns money stress into calm, confident habits. Capture spending in seconds, set real goals, and see progress every week. Clear cash flow views and gentle reminders keep you on track, without judgment. Privacy comes first, so your data stays safe while your decisions get simpler.Creating the Product Roadmap

The roadmap presents how value grows over time. It is not a task list. It is a story of outcomes grouped into releases. Each release delivers a complete slice, from entry to insight. The roadmap leaves room for learning, yet sets clear expectations. It aligns with objectives, such as faster onboarding and higher goal attainment. It also marks boundaries, such as deferring live bank connections. This balance builds trust, while keeping adaptation possible.

The Roadmap in Action

Release One delivers a usable core. People can set categories, add transactions, and see cash flow for the month. Release Two deepens usefulness with recurring templates, goal tracking, and a simple progress dashboard. Release Three strengthens habits through weekly check-ins, meaningful alerts, and clearer trends across ninety days. Release Four adds premium coaching, richer reports, and seasonal improvements that reflect user feedback. Each release stands alone, yet builds upon earlier foundations without adding heavy complexity.

The Principle of Roadmapping

Roadmapping shows sequence without freezing scope. It clarifies why each release exists, and how it contributes to outcomes. It avoids false certainty by focusing on problems solved rather than tasks completed. It highlights dependencies, such as encryption foundations before shared budgets. It opens a path for empirical learning, so feedback can shape the next slice. With this approach, stakeholders see steady progress, and the team keeps agility while honoring commitments.

Release One: Core Experience

The first release focuses on speed and clarity. Users create a budget with helpful defaults. They record income and expenses with a few taps. The app calculates category balances and a month-to-date cash flow view. Offline entry queues gracefully, then syncs. Privacy is enforced by minimal data collection and strong encryption. This release proves the product’s promise, and sets the baseline for measurable habits and early satisfaction.

Release Two: Smart Routines

The second release reduces repeated effort and increases motivation. Users define recurring expenses and income. Goal tracking encourages small, regular transfers toward savings targets. A progress dashboard shows trends and upcoming obligations. Import stubs allow simple upload of bank files for easier reconciliation. The experience remains gentle and honest. People stay engaged because routine work feels lighter, and progress is visible.

Release Three: Habits and Insight

The third release turns weekly check-ins into a reliable ritual. Thoughtful reminders nudge action without pressure. Cash flow views expand to ninety days, revealing patterns and seasonality. Plain language insights highlight overspending risks and helpful adjustments. Shared budgets allow partners to view and coordinate. This release strengthens trust and retention, because users feel guided, not judged, and can collaborate when needed.

Release Four: Growth and Sustainability

The final planned release adds premium value while protecting the core experience. Advanced reports help users plan scenarios and compare months. Optional coaching offers deeper guidance for challenging situations. Seasonal improvements refresh categories, tips, and visuals. Analytics support continuous improvement without compromising privacy. Monetization remains respectful and transparent. The result is a sustainable product that continues to learn and deliver compounding value.

| Item | Release 1: Core Experience (Foundations) | Release 2: Smart Routines | Release 3: Habits and Insight | Release 4: Growth and Sustainability |

|---|---|---|---|---|

| Timeline | Month 1–2 | Month 3–4 | Month 5–6 | Month 7+ |

| Key Features | Category setup with helpful defaults; Quick-add income and expenses; Month-to-date cash flow; Offline queue and sync; Privacy by default; Basic onboarding. | Recurring expense and income templates; Goal creation and progress tracking; Simple progress dashboard; Import stubs for bank files; Easier reconciliation. | Weekly check-in reminders; Ninety-day trends; Plain language insights; Overspend risk highlights; Shared budgets for partners; Improved editing flows. | Advanced reports and scenarios; Optional coaching; Seasonal improvements and tips; Analytics for continuous improvement; Respectful monetization; Ongoing performance tuning. |

| Value Alignment | Vision: Calm, simple budgeting; Problem: High effort to start; Strategy: Deliver a usable core fast. | Vision: Reduce friction; Problem: Repetitive work; Strategy: Automate routines and show progress. | Vision: Build habits; Problem: Drop-off after month one; Strategy: Gentle nudges and clearer insights. | Vision: Sustainable value; Problem: Long-term viability; Strategy: Premium depth with privacy and trust. |

Key Takeaway

Initiation sets direction, alignment, and momentum. A clear vision keeps choices focused. A strong elevator speech unites stakeholders and guides communication. A lightweight roadmap shows how value arrives in steady slices. Each release reduces friction, strengthens trust, or unlocks insight. With these foundations in place, the team can move forward confidently, adapt as they learn, and deliver a budgeting companion that improves real lives, one small win at a time.

Product Architecture and Specification

Why Architecture Matters

Architecture gives structure to ideas, and keeps delivery aligned with outcomes. It shows how parts fit together, and where each feature belongs. A clear blueprint reduces confusion, improves flow, and protects quality. For a budgeting app, architecture shapes decisions about privacy, speed, and usability. It also clarifies how we scale features over time. With the blueprint in place, the team can deliver small increments confidently, while avoiding rework that slows learning and progress.

Three-Layer Architecture for Budgeting

We adopt three layers to keep the system simple and adaptable. The interface layer handles screens, inputs, and the language of money. The application layer manages rules for categories, goals, rollovers, and reminders. The data and services layer stores transactions, secures identities, and supports analytics. This separation creates clean boundaries. It allows focused changes without breaking other parts. It also makes testing easier, and prepares the product for new platforms and integrations.

Architecture Across Releases

The blueprint supports a steady roadmap. Early releases focus on a lean interface and core budgeting rules. Later releases add recurring templates, import stubs, and habit reminders. The services layer begins with local storage and encrypted accounts. It expands to secure sync and privacy-safe analytics. Each capability has a defined home. This clarity keeps work slices thin and independent. The team can ship improvements quickly, while preserving a stable foundation for future growth.

| Category | Description |

|---|---|

| User Interface Layer |

Onboarding and first budget setup; Category management screens with helpful defaults; Quick-add income and expense entry; Recurring templates editor for bills and paychecks; Goal creation and progress dashboard; Cash flow views with trends and plain language insights; Notifications center for gentle reminders and alerts; Shared budget views for partners, with simple permissions. |

| Application Logic Layer |

Budget rules engine for category balances and rollovers; Transaction classifier for suggestions and validations; Recurring scheduler for upcoming income and expenses; Goal tracker that allocates contributions and milestones; Insight generator for overspend risks and helpful tips; Reconciliation flows for import stubs and duplicates; Sync manager for offline queue and conflict resolution; Access control for shared budgets and roles. |

| Data and Services Layer |

Local storage for encrypted accounts and cached transactions; Secure cloud database for optional sync and shared budgets; File import service for common bank formats and parsing; Encryption, identity, and session management with least privilege; Privacy-safe analytics with minimal, aggregated signals; Logging and audit trails for sensitive operations; Optional coaching service and premium report generation. |

| Alignment with Roadmap |

Release one: onboarding, categories, quick-add, cash flow basics; Release two: recurring templates, goals, import stubs, progress dashboard; Release three: reminders, ninety day trends, insights, shared budgets; Release four: advanced reports, optional coaching, analytics for improvement. |

The Product Datasheet

A datasheet summarizes the product for busy stakeholders. It answers five questions clearly. What the app is, who it serves, which features matter now, how the business benefits, and how users benefit. The document fits on a single page. It avoids jargon and deep technical detail. It links our vision to concrete outcomes. Stakeholders can scan it before reviews, and stay aligned on priorities. The datasheet also helps onboard new team members quickly.

Datasheet Highlights for the Budgeter

The datasheet presents a concise story. The app is a friendly companion for everyday budgeting. Target users include busy households and partners who share finances. Key features include category setup, quick-add transactions, recurring templates, goals, and cash flow views. Business value comes from retention, trust, and transparent monetization. User value comes from clarity, fewer surprises, and visible progress. The page acts as a reference during planning, and supports decisions about scope and messaging.

From Datasheet to Backlog

The datasheet guides backlog creation without dictating solutions. It frames outcomes that matter most, such as faster onboarding and improved weekly check-ins. Product goals become epics, then stories that deliver thin, complete slices. For example, “quick-add transactions” becomes input flows, validations, and helpful defaults. “Cash flow views” becomes data aggregation, summaries, and plain language insights. Each story maps to a layer in the architecture. This mapping preserves coherence as features grow.

| Product Name | Personal Budgeter App |

|---|---|

| Company | ClarityBudget Inc. |

| Product Overview | The Personal Budgeter App is a friendly companion for everyday money management. It simplifies tracking, reveals patterns, and turns goals into weekly progress. The app focuses on quick capture, clear insights, and privacy by default. It helps households understand where money goes, reduce surprises, and build steady habits that last. |

| Target Users |

|

| Key Features |

|

| Business Value |

|

| User Value |

|

Understanding Specifications

Specifications turn broad intentions into testable requirements. They include functional and non-functional details. Functional requirements describe behavior, such as creating categories, editing transactions, and tracking goals. Non-functional requirements define qualities like performance, reliability, security, and accessibility. Constraints capture boundaries, such as privacy policies and platform choices. Together, these elements create shared expectations. They reduce ambiguity during development. They also support acceptance testing, and improve predictability across Sprints and releases.

Functional Requirements for Budgeting

Functional details focus on end-to-end value. Users can create, edit, and archive categories with helpful defaults. They can add income and expenses in seconds, with automatic date and category suggestions. Recurring templates handle bills and paychecks cleanly. Goal tracking records targets and contributes progress automatically. Cash flow views summarize the current month and trends. Import stubs accept common bank file formats, and assist reconciliation. Gentle reminders support weekly check-ins without pressure or guilt.

| Category | Description |

|---|---|

| Product Overview | The Personal Budgeter App simplifies tracking, reveals patterns, and turns goals into weekly progress. Lightweight, privacy first, and designed for mobile and web. |

| Functional Requirement — Core Budgeting |

|

| Functional Requirement — Recurring Items |

|

| Functional Requirement — Goals |

|

| Functional Requirement — Cash Flow and Insights |

|

| Functional Requirement — Import Stubs and Reconciliation |

|

| Functional Requirement — Reminders and Notifications |

|

| Functional Requirement — Shared Budgets |

|

| Non-Functional Requirement — Performance |

|

| Non-Functional Requirement — Security and Privacy |

|

| Non-Functional Requirement — Reliability and Scalability |

|

| Non-Functional Requirement — Compatibility |

|

| Non-Functional Requirement — Accessibility |

|

| Constraint — Data |

|

| Constraint — Timeline |

|

| Constraint — Monetization |

|

| Constraint — Team Velocity |

|

| Acceptance Metrics |

|

Non-Functional Requirements and Constraints

Qualities protect trust and usability. The app loads the dashboard in under two seconds on mid-range devices. Transaction saves complete within one second, online or offline. Data is encrypted at rest and in transit, using industry best practices. Access follows least privilege, with secure session handling. The interface meets accessibility guidelines, including readable contrast and large touch targets. Analytics collect minimal, aggregated signals. No sensitive financial content leaves the device without explicit consent.

Making Specifications Measurable

Measurable standards guide development and testing. First budget creation completes in under ten minutes for new users. Ninety-five percent of common actions succeed on the first attempt. Offline entries queue reliably, and sync within ten seconds after reconnecting. Import stubs parse standard formats with clear error explanations. Weekly reminder delivery respects quiet hours automatically. Critical paths maintain automated tests with ninety percent coverage. These measures keep quality visible, and enable confident iteration.

Key Takeaway

Architecture, datasheet, and specifications work together to convert vision into tangible progress. The architecture provides clean boundaries and predictable growth. The datasheet aligns stakeholders on value and scope. The specifications define behavior and quality in measurable terms. With these tools in place, the team can ship small, valuable slices. Each release strengthens clarity, reduces effort, and deepens trust, bringing households closer to calm, confident money management.

Building the Backlog

From Vision to Backlog

The product backlog is a single, ordered list of possible work. It connects the budgeting vision to concrete user value. Ideas begin broad and become smaller as we learn. Epics describe large goals, features describe key capabilities, and stories define testable slices. Each item should link to an outcome, not a task. By aligning the backlog with the roadmap and specifications, we ensure effort supports clarity, habits, and trust for everyday money decisions.

Backlog Hierarchy Explained

A clear hierarchy keeps work understandable and focused. Epics group related goals like onboarding or cash flow insight. Features express specific capabilities within those goals. User stories deliver small, independent increments that users can experience. For example, the epic “Capture Spending” includes the feature “Quick-Add Entry.” That feature produces stories such as, “As a user, I want to add an expense in seconds, so I keep my budget current.”

Writing Good User Stories

User stories describe value in plain language. The format is simple and powerful. “As a user, I want a capability, so I gain a benefit.” This structure keeps the team honest about who matters and why. Examples help. “As a new budgeter, I want helpful category defaults, so setup is fast.” “As a partner, I want read access, so I can view shared spending without confusion.” Each story must be understandable, valuable, and testable.

Qualities of Strong Stories

Strong stories follow qualities that support flow and learning. They should be independent, negotiable, valuable, estimable, small, and testable. Independence reduces hidden coupling across items. Negotiable means solutions can evolve during refinement. Valuable keeps attention on outcomes, not activity. Estimable enables planning and forecasting. Small supports completion within a Sprint. Testable provides objective results. If a story is too broad, split it into thinner slices that still deliver user value.

Epic Examples for Budgeting

Concrete epics align the backlog with user outcomes. Helpful epics for budgeting include onboarding, capture spending, recurring items, goals, and insight. Onboarding reduces time to first budget. Capture spending makes entry fast and forgiving. Recurring items reduce repeated work for bills and paychecks. Goals connect actions to savings progress. Insight reveals trends and risks in plain language. Each epic becomes features, and then stories, that users can feel quickly.

Feature Examples That Fit

Features describe what the product can do within an epic. Useful features include quick-add transactions, category editor, recurring templates, cash flow views, and import stubs. Quick-add supports entry in a few taps. The category editor provides defaults and simple changes. Recurring templates schedule predictable items. Cash flow views show where money goes across time. Import stubs allow file uploads without live bank connections. Each feature yields stories that are small and verifiable.

Writing Acceptance Criteria

Acceptance criteria define when a story is complete. They remove guesswork and prevent rework. For “Quick-Add Expense,” criteria might include, “User selects a category,” “Amount and date are required,” and “Save completes within one second.” For “Recurring Template,” criteria might include, “User schedules monthly bills,” “Skip a single instance,” and “Next occurrence appears in upcoming items.” Clear criteria guide development, support tests, and allow confident acceptance by the product owner.

Why Acceptance Criteria Matter

Acceptance criteria make value measurable and visible. They shape design and testing before code begins. They help the team discuss boundary cases calmly. They also prevent surprises during review. When everyone sees the same finish line, handoffs are smoother. Testers create cases from criteria. Developers craft solutions that meet those cases. The product owner inspects results against the same list. The outcome is predictable progress, fewer defects, and faster feedback.

| Epic | Feature | User Story | Acceptance Criteria |

|---|---|---|---|

| Onboarding | First Budget Setup | As a new user, I want helpful defaults so I can create a budget quickly. | Wizard offers default categories; user names the budget; setup completes in under ten minutes. |

| Onboarding | Tutorial Hints | As a new user, I want short tips so I can learn without reading a manual. | Contextual hints appear once; user can dismiss; tips are stored as completed. |

| Capture Spending | Quick-Add Entry | As a user, I want to add an expense in seconds so my budget stays current. | Amount, date, category required; save completes within one second; success toast shown. |

| Capture Spending | Category Suggestions | As a user, I want smart suggestions so I spend less time picking categories. | Recent choices auto-suggest; user can override; selection learned for next time. |

| Categories | Editor | As a user, I want to add and edit categories so the budget fits my life. | Create, rename, archive available; changes reflected immediately; archived items hidden from lists. |

| Categories | Monthly Limits | As a user, I want limits per category so I can control spending. | User sets limit; remaining balance updates after each entry; negative balance clearly shown. |

| Recurring Items | Bill Templates | As a user, I want recurring bills so I do not re-enter them monthly. | Schedule supports monthly and biweekly; skip single occurrence; next date displayed. |

| Recurring Items | Income Templates | As a user, I want recurring income so paychecks appear on time. | Template posts on schedule; editable before posting; audit trail records changes. |

| Goals | Savings Targets | As a user, I want savings goals so I can track progress toward milestones. | Target amount and date required; progress bar updates after contributions; milestone toast shown. |

| Goals | Auto-Contribution | As a user, I want automatic contributions so progress is steady. | Percentage or fixed amount supported; contributions logged; user can pause anytime. |

| Cash Flow | Month View | As a user, I want a month view so I can see current inflows and outflows. | Totals calculated instantly; net position visible; drill-down opens transaction list. |

| Cash Flow | Ninety-Day Trends | As a user, I want trends so I can spot patterns and adjust. | Three months shown; categories sortable; comparison to last month visible. |

| Insights | Plain Language Notes | As a user, I want clear insights so I understand risks and options. | Cards show overspend risk and suggestions; no blame language; links open relevant screens. |

| Import and Reconcile | Bank File Import | As a user, I want to import bank files so I can reconcile faster. | CSV and OFX supported; preview before save; errors explained in plain language. |

| Import and Reconcile | Duplicate Matching | As a user, I want duplicate detection so I avoid double entries. | Potential duplicates flagged; user confirms merge; final list shows unique entries. |

| Reminders | Weekly Check-In | As a user, I want weekly reminders so I keep my budget updated. | Reminder respects quiet hours; snooze available; completion recorded for habit tracking. |

| Reminders | Bill Alerts | As a user, I want upcoming bill alerts so I avoid late fees. | Alerts sent two days before due; link opens the bill entry; user can dismiss. |

| Shared Budgets | Partner Access | As a partner, I want view or edit rights so we can manage together. | Invite by email; roles are view or edit; activity history records changes. |

| Privacy and Security | Data Protection | As a user, I want strong privacy so my financial data feels safe. | Encryption at rest and in transit; sessions secured; data export and delete available. |

| Analytics and Improvement | Feedback Loop | As a product owner, I want post-release feedback so we can improve. | In-app survey after releases; responses stored; dashboard shows themes and counts. |

Definition of Done

The Definition of Done applies to every story, across the backlog. It is a shared agreement on quality. It may include code review, tests that pass, accessibility checks, and updated documentation. It can also include privacy checks and performance thresholds. For the budgeting app, the agreement includes encryption verified, automated tests on critical paths, and product owner acceptance. A consistent Definition of Done protects trust, releases, and the user experience.

Key Components of Done

A practical checklist keeps quality real. Helpful components include, “Code merged with review,” “Unit and integration tests green,” and “No critical defects open.” Include, “Performance within targets,” “Accessibility checks pass,” and “Analytics events verified.” Add, “Help content updated,” and “Product owner accepts the story.” This checklist removes ambiguity. It also shortens debates during review. The team can adapt the list as the product grows, while keeping standards clear.

| Category | Description |

|---|---|

| General Criteria | Code is written, peer reviewed, and merged to main without conflicts. |

| General Criteria | All acceptance criteria are verified on staging with real test data. |

| General Criteria | No critical or high severity defects remain open. |

| Quality and Testing | Unit and integration tests are added and pass in continuous integration. |

| Quality and Testing | Automated regression suite runs clean, including quick add and rollovers. |

| Quality and Testing | Manual exploratory testing completed for edge cases and error flows. |

| Performance | Dashboard load stays under two seconds on mid range devices. |

| Performance | Transaction save completes within one second, online and offline. |

| Accessibility | Text scales, contrast meets guidelines, and controls are keyboard and screen reader friendly. |

| Security and Privacy | Data is encrypted at rest and in transit, with secrets stored securely. |

| Security and Privacy | Privacy review completed, with minimal data collection and clear consent checks. |

| Security and Privacy | Data export and delete flows verified for the new feature. |

| Data Integrity | Migrations tested, category balances correct, and rollovers reconcile accurately. |

| Notifications | Reminders respect quiet hours, and settings support snooze and opt out. |

| Import and Reconciliation | CSV and OFX parsing verified, with duplicate detection and clear error messages. |

| Analytics | Events are minimal and privacy safe, with names, schemas, and dashboards updated. |

| Integration and Deployment | Feature integrates without breaking existing paths, including offline sync. |

| Integration and Deployment | Build promoted to staging with release notes and rollback plan documented. |

| Documentation | User story updated with final results, links, and test evidence. |

| Documentation | Technical docs updated, including API contracts and configuration settings. |

| Support Readiness | Help content and troubleshooting steps updated for support teams. |

| Localization | User facing copy reviewed for clarity and prepared for translation. |

| Business and Stakeholder Sign Off | Product owner accepts the story against acceptance criteria. |

| Business and Stakeholder Sign Off | Alignment confirmed with product vision, roadmap, and release goals. |

| Release Readiness | Increment is potentially shippable, with monitoring and alerts configured. |

From Refinement to Ready

Refinement turns rough ideas into stories that are ready to start. The team clarifies scope, splits large items, and writes criteria. Estimates help forecast Sprint capacity. Dependencies across layers become clear and manageable. Risks are noted early, so surprises are rare. A story is ready when the team understands the goal, size, criteria, and test approach. Ready items flow into planning. This rhythm keeps delivery steady and confidence high.

Bringing It All Together

The backlog turns vision into steady increments of value. Epics create direction. Features describe capabilities. Stories deliver small, testable slices that users can feel. Acceptance criteria define success for each story. The Definition of Done sets the standard for quality across all work. With refinement, estimates, and readiness, the team moves calmly from idea to release. Users see progress often. Trust grows with each improvement. The product becomes better week by week.

Release Planning

Purpose of Release Planning

Release planning connects the backlog to delivery dates that matter. It answers when groups of features will reach users. The goal is clarity, not perfect prediction. Plan the nearest release in detail, and keep later releases flexible. This balance allows responsible commitments and room to learn. For a budgeting app, release planning shows how ideas become increments that reduce effort, reveal insight, and build trust. Everyone sees the path from concept to a useful outcome.

Defining the Release Goal

A release goal creates alignment across roles and decisions. It describes the meaningful outcome the release will achieve. For our first release, the goal is simple and strong. Deliver a usable budgeting core that supports category setup, quick-add entries, and a clear month view. This goal guides choices when tradeoffs appear. Work that directly supports the foundation stays. Enhancements wait. The goal becomes the lens for prioritization, scope control, and stakeholder expectations.

| Goal Statement | Deliver a usable budgeting core that lets people create a budget, record transactions quickly, and see a clear month view. |

|---|---|

| Intended Outcome | Reduce effort to start budgeting, build confidence with early wins, and establish trust through privacy and reliability. |

| In-Scope Capabilities |

|

| Out-of-Scope (Deferred) |

|

| Success Metrics |

|

| Non-Functional Targets |

|

| Key Risks and Mitigations |

|

| Dependencies |

|

Prioritization Strategy

Not every backlog item is equally important. Prioritization ensures early releases are valuable even if scope changes. Favor items with high user value, risk reduction, or heavy dependencies. For the first budgeting release, category setup, quick-add transactions, and a reliable cash flow view take priority. Recurring templates and goal tracking arrive later. This sequence ensures users can start, record spending, and see results. The approach protects usefulness if time tightens, or plans evolve.

Backlog to Release Plan

Turning the backlog into a release plan means grouping stories that fulfill the goal. Each story includes acceptance criteria and an estimate. “Add expense in seconds” supports quick capture. “Show month-to-date balance” supports visibility. “Create category with defaults” supports setup speed. Together, these stories form a coherent slice. The product owner orders them to maximize learning and value. The team checks capacity and dependencies. The output is a realistic, inspectable plan.

Estimating Story Points

Estimation supports forecasting without false certainty. Story points measure relative effort, complexity, and risk. Teams compare stories against known references to stay consistent. Large items are split during refinement, improving predictability. Velocity emerges from completed work, not wishful thinking. When estimates meet recent velocity, the plan is believable. If capacity is tight, lower priority stories move out. Estimation is a tool for honesty, enabling earlier conversations about scope choices.

| Epic | Feature | User Story | Acceptance Criteria | Timeline | Release Goal | Story Points |

|---|---|---|---|---|---|---|

| Onboarding | First Budget Setup | As a new user, I want helpful defaults so I can create a budget quickly. | Wizard shows default categories; user names budget; setup completes under ten minutes. | Month 1–2 | Deliver a usable budgeting core. | 8 |

| Onboarding | Tutorial Hints | As a new user, I want short tips so I learn without a manual. | Contextual hints appear once; user can dismiss; completion state is saved. | Month 1–2 | Deliver a usable budgeting core. | 3 |

| Categories | Default Set | As a user, I want a sensible starter set so I begin fast. | Starter categories preloaded; user can rename; unused items removable. | Month 1–2 | Deliver a usable budgeting core. | 3 |

| Categories | Editor | As a user, I want to add and edit categories so the budget fits my life. | Create, rename, archive supported; changes reflected instantly; archived hidden by default. | Month 1–2 | Deliver a usable budgeting core. | 8 |

| Categories | Monthly Limits | As a user, I want limits per category so I can control spending. | Limit settable; remaining updates after entries; negative balance clearly shown. | Month 1–2 | Deliver a usable budgeting core. | 5 |

| Capture Spending | Quick-Add Entry | As a user, I want to add an expense in seconds so my budget stays current. | Amount, date, category required; save under one second; success toast shown. | Month 1–2 | Deliver a usable budgeting core. | 5 |

| Capture Spending | Category Suggestions | As a user, I want smart suggestions so I spend less time picking categories. | Recent choices suggested; user can override; preference learned for next time. | Month 1–2 | Deliver a usable budgeting core. | 5 |

| Cash Flow | Month View | As a user, I want a month view so I see inflows and outflows clearly. | Totals accurate; net position visible; drill down opens transaction list. | Month 1–2 | Deliver a usable budgeting core. | 8 |

| Platform | Offline Queue and Sync | As a user, I want offline entry so I can log transactions anywhere. | Entries queue offline; sync within ten seconds; conflicts resolved safely. | Month 1–2 | Deliver a usable budgeting core. | 8 |

| Privacy and Security | Foundations | As a user, I want strong privacy so my financial data feels safe. | Encryption at rest and in transit; secure sessions; data export and delete available. | Month 1–2 | Deliver a usable budgeting core. | 8 |

| Performance | Dashboard Load Target | As a user, I want a fast dashboard so I can check status quickly. | Dashboard loads under two seconds on mid range devices; monitored with metrics. | Month 1–2 | Deliver a usable budgeting core. | 3 |

| Accessibility | Baseline Compliance | As a user, I want readable screens so I can use the app comfortably. | Scalable text; adequate contrast; controls usable by keyboard and screen reader. | Month 1–2 | Deliver a usable budgeting core. | 3 |

| Error Handling | Friendly Messages | As a user, I want clear errors so I can fix problems quickly. | Plain language errors; recovery steps shown; no data loss on failure. | Month 1–2 | Deliver a usable budgeting core. | 3 |

| Analytics and Improvement | Minimal Telemetry | As a product owner, I want basic signals so I gauge onboarding success. | Events for setup completion and first entry; privacy safe; dashboard displays counts. | Month 1–2 | Deliver a usable budgeting core. | 3 |

| Release Operations | Staging and Rollback | As a team member, I want safe releases so issues are reversible. | Build deploys to staging; release notes prepared; rollback plan documented and tested. | Month 1–2 | Deliver a usable budgeting core. | 3 |

Planning Sprints

| Sprint | Focus | Planned Items | Approx. Points |

|---|---|---|---|

| Sprint 1 | Onboarding and Categories | First Budget Setup; Tutorial Hints; Default Category Set; Category Editor. | 22–24 |

| Sprint 2 | Spending Capture | Monthly Limits; Quick-Add Entry; Category Suggestions; Month View. | 23–26 |

| Sprint 3 | Platform Foundations | Offline Queue and Sync; Performance Target; Accessibility Baseline; Friendly Errors. | 18–20 |

| Sprint 4 | Trust and Release Readiness | Privacy and Security Foundations; Minimal Telemetry; Staging and Rollback. | 16–18 |

Forecasting with Velocity

Velocity translates estimates into timelines. Use actual completed points over several Sprints, not one. Consider holidays, onboarding, and known risks. Keep a range, not a single number. Communicate the plan as a forecast, and update it often. If the team averages forty points, do not plan forty every Sprint. Leave space for unplanned work, and learning. This approach keeps expectations healthy. Stakeholders see progress and uncertainty clearly, which builds trust.

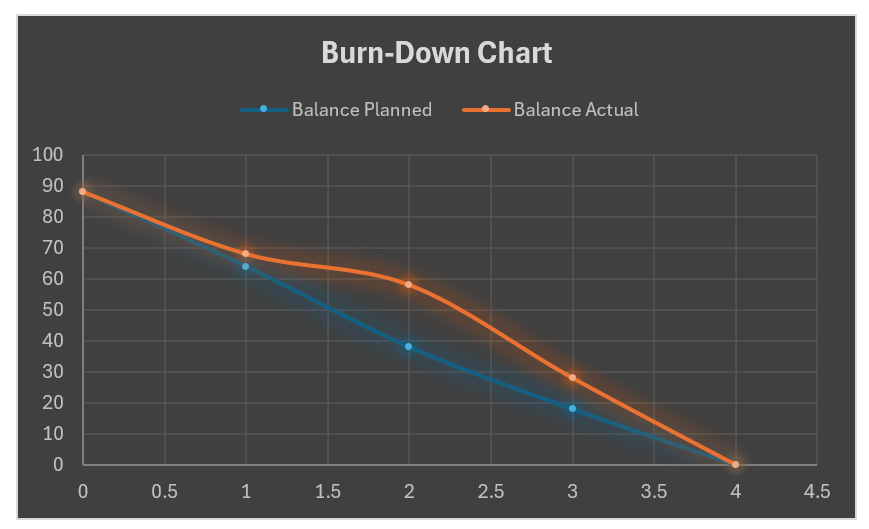

Release Burndown Chart

A release burndown chart tracks progress toward the goal. It shows total remaining points over time. Each Sprint, completed stories reduce the total. The chart highlights trends early. If work grows due to discovery, the line may flatten. If throughput improves, the line drops faster. The chart invites calm conversations about scope, sequencing, or dates. It is not a scoreboard. It is a shared instrument for transparency, adaptation, and responsible decision making.

| Release | Burned down Planned | Burned down Actual | Balance Planned | Balance Actual |

|---|---|---|---|---|

| 0 | 24 | 20 | 88 | 88 |

| 1 | 26 | 10 | 64 | 68 |

| 2 | 20 | 30 | 38 | 58 |

| 3 | 18 | 28 | 18 | 28 |

| 4 | 0 | 0 |

I have exadurated the actual points balance so that lines are not sticking together. If project runs smoothly, both of the lines should follow closly together.

Inspecting and Adapting the Plan

Plans change as learning appears. New insights from users can reorder features. Technical constraints can split stories. Risks can advance or fade. Use Sprint Reviews to check alignment with the release goal. Use backlog refinement to keep items small and clear. Update forecasts when velocity shifts. Communicate changes promptly and plainly. Adaptation is not failure. It is a sign of healthy planning that respects outcomes over rigid promises.

Key Takeaway

Release planning bridges vision and reality with honest forecasts and clear goals. It orders work so the most valuable features arrive first. It uses estimates, velocity, and visuals to guide discussions, not dictate outcomes. For a budgeting app, this approach delivers steady slices that reduce effort, highlight patterns, and protect privacy. With transparency and adaptation, the team ships meaningful improvements often, while keeping stakeholders confident and informed.

Sprint Planning

Defining the Sprint Goal

Sprint planning starts by agreeing on a clear, valuable goal. A focused goal guides tradeoffs and day-to-day choices. For the budgeting app, a strong first Sprint goal is delivering a usable spending capture slice. This includes quick-add entry, helpful category defaults, and a simple month view. The goal is realistic, testable, and directly useful. With this clarity, the team can align estimates, tasks, and reviews to one shared outcome, not a scattered list of activities.

Choosing Stories That Serve the Goal

After the goal is set, the team selects stories that contribute directly. Stories should deliver end-to-end value, not partial parts. For spending capture, choose quick-add expense, category suggestions, and month-to-date totals. Defer unrelated items, such as recurring templates or import stubs. The product owner orders stories to maximize early feedback. The team checks dependencies and trims scope where needed. This discipline helps protect the goal, even if surprises appear during the Sprint.

| Goal Statement | Deliver a usable spending capture slice that enables quick entry, helpful defaults, and a simple month view. |

|---|---|

| Focus | Onboarding and categories, quick-add expense, month-to-date visibility. |

| In-Scope Stories |

|

| Out-of-Scope |

|

| Done Criteria |

|

| Success Metrics |

|

| Risks and Mitigations |

|

Estimating with Story Points

Story points measure relative effort, risk, and complexity. The team compares each story to known references to maintain consistency. For example, quick-add expense might be five points, while the month view might be eight points. Large stories are split until they fit comfortably within a Sprint. Estimates inform capacity planning, without pretending to be precise time. Over several Sprints, observed velocity makes forecasting practical, honest, and easier to explain to stakeholders.

Breaking Work into Tasks

Tasks translate each story into concrete steps. Tasks are technical and small, while stories remain user focused. Quick-add expense tasks might include input validation, save logic, optimistic updates, and error handling. The month view tasks might include data aggregation, category balance calculations, and display formatting. Testing tasks cover unit and integration checks. Documentation tasks ensure help content matches the updated flows. Clear tasks reduce handoff friction, surface risks early, and improve daily coordination.

Acceptance Criteria and Shared Clarity

Acceptance criteria define “done” before work begins. They create alignment across roles and reduce rework. For quick-add expense, criteria might include required fields, save under one second, and success confirmation. For month view, criteria might include accurate totals, drill-down to transactions, and readable contrast. Criteria are testable and unambiguous. They guide design, development, and quality checks. During review, the product owner accepts or returns the story using the same list, not subjective impressions.

| Story ID | Description | Acceptance Criteria | Story Points |

|---|---|---|---|

| SB-101 | First budget setup with sensible default categories, and a short, guided wizard. |

|

8 |

| SB-102 | Quick-add expense entry to record spending in seconds. |

|

5 |

| SB-103 | Category suggestions that learn from recent choices. |

|

3 |

| SB-104 | Month view showing totals, net position, and quick drill downs. |

|

5 |

| SB-105 | Friendly error messages and safe recovery for common failures. |

|

3 |

Building the Sprint Backlog Board

The Sprint backlog is made visible on a board. Columns show simple states, such as To Do, In Progress, and Done. Each story has tasks that advance across the board. The team reviews the board in the daily event to expose blockers and adjust plans. Visual management improves transparency and coordination. It also highlights work in progress that should be limited. Small batch flow reduces context switching, improves cycle time, and supports reliable delivery.

| To Do | In Progress | Done |

|---|---|---|

|

SB-101: First Budget Setup — Currency selector. SB-101: First Budget Setup — Save progress between steps. SB-102: Quick-Add Expense — Undo action and toast timing. SB-103: Category Suggestions — Override interaction design. SB-104: Month View — Drill-down filter behavior. SB-105: Friendly Errors — Support logs without sensitive data. |

SB-101: First Budget Setup — Default categories content and copy. SB-101: First Budget Setup — Wizard navigation and validation. SB-102: Quick-Add Expense — Save logic and optimistic update. SB-103: Category Suggestions — Ranking based on recent choices. SB-104: Month View — Totals and net position calculations. |

SB-101: First Budget Setup — Screen layout and accessibility baseline. SB-102: Quick-Add Expense — Input fields and basic validation. SB-104: Month View — Dashboard load profile under two seconds. SB-105: Friendly Errors — Plain language error library. |

Forecasting Capacity and Managing Risks

Capacity planning begins with recent velocity and known constraints. Leave a buffer for unplanned work and discovery. Identify risks that could threaten the goal. For the budgeting app, early risks include data model mistakes, performance regression on mid-range phones, and privacy reviews. Add visible mitigation tasks, such as performance profiles and security checks. If forecast exceeds capacity, remove lower value stories. The plan remains believable because it respects real limits and known uncertainties.

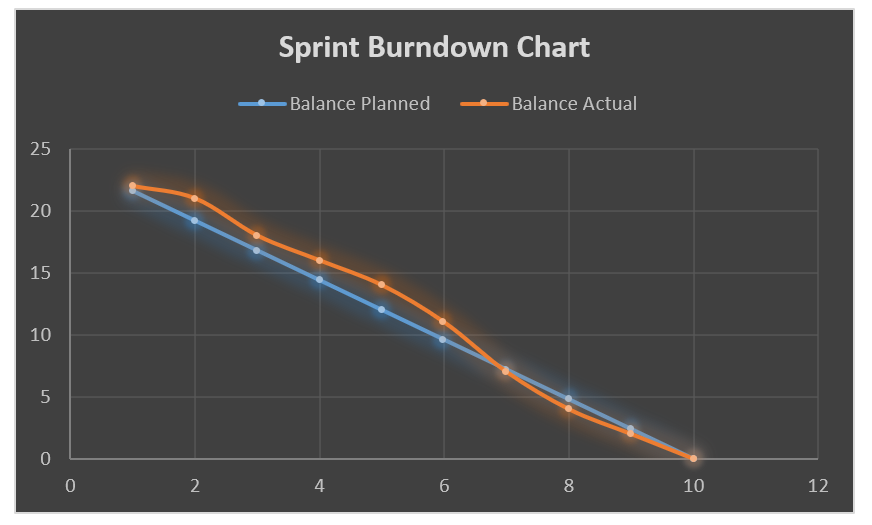

Using a Sprint Burndown

The burndown tracks remaining points each day against an ideal trend. It highlights whether progress matches expectations. If the line flattens, investigate early. Common causes include blocked tasks, unclear criteria, or hidden dependencies. The burndown invites calm conversations about scope or sequencing. It is not a scoreboard. It is a shared instrument for adaptation. When combined with the board and acceptance criteria, it helps the team maintain focus on the Sprint goal.

| Day | Burned down Planned | Burned down Actual | Balance Planned | Balance Actual |

|---|---|---|---|---|

| 1 | 2.4 | 2 | 21.6 | 22 |

| 2 | 2.4 | 1 | 19.2 | 21 |

| 3 | 2.4 | 3 | 16.8 | 18 |

| 4 | 2.4 | 2 | 14.4 | 16 |

| 5 | 2.4 | 2 | 12.0 | 14 |

| 6 | 2.4 | 3 | 9.6 | 11 |

| 7 | 2.4 | 4 | 7.2 | 7 |

| 8 | 2.4 | 3 | 4.8 | 4 |

| 9 | 2.4 | 2 | 2.4 | 2 |

| 10 | 2.4 | 2 | 0.0 | 0 |

| 0 | 24 | 24 |

Coordination Across Roles

Effective planning depends on shared ownership. The product owner ensures selected stories deliver meaningful value. The scrum master supports flow, facilitates decisions, and removes impediments. Developers and designers split work into right-sized tasks, swarm when blocked, and pair on complex areas. Quality specialists prepare tests aligned to criteria and automate critical paths. Everyone inspects the plan daily, adjusts openly, and protects the goal. Collaboration beats individual heroics, especially under time pressure.

Adapting Without Losing Direction

Change is expected during the Sprint, but the goal remains stable. When discovery reveals complexity, split stories and protect the thin, usable slice. If a dependency blocks progress, reorder tasks or swap in another story that serves the goal. Keep communication frequent and concise. Update the board and burndown promptly. Adaptation is not churn. It is purposeful movement toward the same outcome, guided by clarity and the smallest complete increments.

Key Takeaway

Sprint planning turns ideas into a two-week promise the team can keep. A clear goal, selected stories, estimates, tasks, acceptance criteria, a visible board, and a steady burndown create alignment. For the budgeting app, this rhythm delivers small, valuable experiences, such as quick capture and a useful month view. Each Sprint reduces effort, deepens trust, and invites feedback. With these habits, the product grows predictably, and real users feel progress sooner.

Managing Risks

Why Risk Management Matters

Great products fail when hidden risks become late surprises. Our budgeting app handles private data and money choices. That raises the stakes for quality and trust. Early, visible risk management keeps surprises small and solvable. We identify threats, agree on owners, and track mitigations as normal work. The goal is not to eliminate risk. The goal is to reduce uncertainty, protect outcomes, and make steady progress. Calm habits beat heroic recoveries every time.

Finding Risks Through Whole-Team Brainstorming

Begin with a short, time-boxed workshop that invites every perspective. Designers call out usability risks and confusing copy. Engineers surface data, performance, and integration concerns. The product owner highlights business deadlines and dependency risks. Support names issues that frustrate new users. Ask for concrete examples, not vague fears. Capture each item as a concise statement with a cause and impact. This shared sweep uncovers blind spots and builds collective ownership.

Risk Categories for a Budgeting App

Useful categories speed discovery and reduce duplication. Privacy risks include weak encryption and excessive data collection. Accuracy risks include wrong category balances and broken rollovers. Reliability risks include offline sync conflicts and lost entries. Experience risks include slow dashboards and confusing error messages. Delivery risks include unclear scope and missing estimates. Add a short “other” bucket for outliers. Sorting by category helps patterns emerge, and supports targeted mitigations later.

Turning Findings into Trackable Cards

Each risk becomes a simple card with consistent fields. Include a short title, a clear description, and an owner. Add cause, impact, and likelihood. Note the first mitigation step and a target date. Keep language plain and testable. For example, “Month view totals can miscalculate after rollovers.” Cause, “edge case in category rules.” Impact, “trust loss and support spikes.” Mitigation, “add tests and refactor calculation path.” Clear cards invite action, not debate.

Visualizing Risks on a Kanban-Style Board

Make risks visible with a simple board labeled High, Medium, and Low. Place cards by current severity and impact. Revisit the board during daily coordination to move items as work lands. Example, “Encryption key handling” starts High until audits pass. “Dashboard performance” sits Medium until profiles finish. “Error copy tone” begins Low, then rises if confusion persists. The board encourages fast conversations and keeps attention on the most important problems.

| High Risk | Medium Risk | Low Risk |

|---|---|---|

|

Encryption key handling during setup — Score 9. Category balance calculation after edits — Score 8. Offline queue conflict on re-sync — Score 8. Dashboard load exceeds target on mid-range phones — Score 7. |

Wizard progress not saved between steps — Score 6. Quick-add optimistic update shows duplicate entry — Score 6. Month view totals mismatch drill-down list — Score 5. Error messages reveal technical details — Score 5. |

Category suggestion ranks poorly for new users — Score 4. Accessibility contrast or tap targets borderline — Score 3. Undo toast timing unclear to users — Score 3. Minimal telemetry misconfigured or too sparse — Score 2. |

Defining Risk Ownership and Accountability

Every card has one clear owner who drives progress. Ownership does not mean working alone. Owners call the right people together, agree on steps, and report movement. They update the board and note blockers early. Rotate ownership to match expertise and load. Security owns encryption concerns. Backend owns rollovers and balances. Mobile owns offline queue and sync conflicts. Shared responsibility turns risks into normal workflow, not special projects handled later.

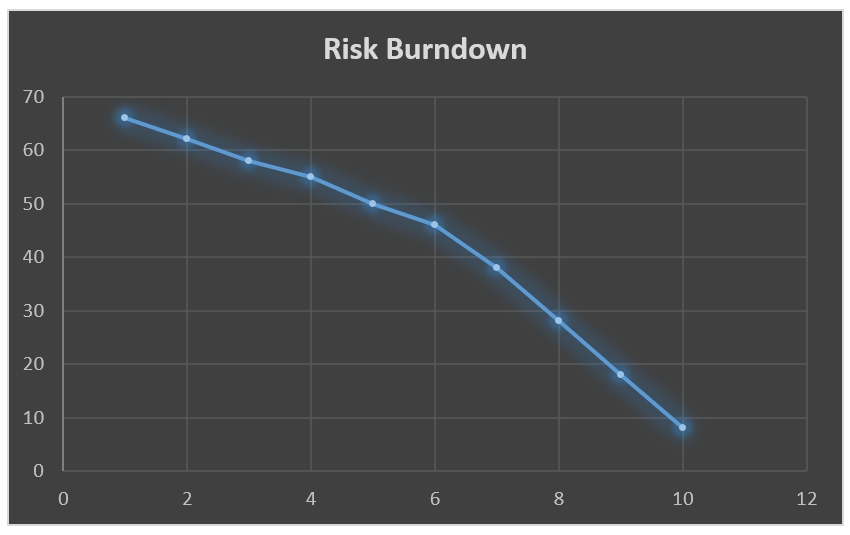

Measuring Exposure with a Risk Burndown

A risk burndown chart tracks total exposure over time. Assign each risk a score based on impact and likelihood. Sum scores each day, then plot planned versus actual. The planned line trends down as mitigations finish. The actual line shows reality. If it flattens or rises, inspect quickly. Reorder work, split mitigations, or add a spike. The chart is not a scoreboard. It is a conversation starter that preserves transparency.

Example Exposure for Early Releases

Imagine Release One starts at a high exposure due to privacy and accuracy concerns. Completing encryption audits drops the line. Finishing a rollovers refactor drops it again. Discovering import parsing issues adds points, then drops after fixes land. The picture tells the story without blame. Leaders see progress and remaining threat. Teams see which mitigation matters most next. Everyone shares the same view, which reduces anxiety and noise.

| Day | Total Risk |

|---|---|

| 1 | 66 |

| 2 | 62 |

| 3 | 58 |

| 4 | 55 |

| 5 | 50 |

| 6 | 46 |

| 7 | 38 |

| 8 | 28 |

| 9 | 18 |

| 10 | 8 |

Linking the Board and Burndown

The board tracks individual risks. The burndown tracks overall exposure. Connect them with a weekly rhythm. As a High card moves to Medium, reduce its score. When a mitigation finishes, move the card to Low and reduce exposure again. If a new risk appears, add a card and increase exposure. This loop turns risk work into measurable progress. It also celebrates invisible wins, like privacy reviews or performance profiles.

Embedding Risk Work in Scrum Events

Use Sprint Planning to include mitigation stories that protect the Sprint goal. Keep them small and testable. Use Daily coordination to surface blockers and adjust quickly. Use the Review to report exposure movement clearly, alongside delivered features. Use the Retrospective to improve detection and response habits. For example, adopt stronger test data for balances. Or refine error copy standards. Small improvements compound fast, and reduce future surprises.

Common Risks and Practical Mitigations

Privacy risk, address with encryption, least privilege access, and secure sessions. Accuracy risk, guard with unit tests on balances and rollovers. Reliability risk, test offline queueing and conflict resolution on mid-range devices. Experience risk, profile the dashboard to hit load targets. Delivery risk, sharpen acceptance criteria and split large stories. Maintain a short playbook with these steps. Reuse it across Sprints, and update it as new lessons appear.

Working Definition of “Risk Done”

Declare a risk mitigated when clear conditions are met. Tests cover the failure path and pass reliably. Monitoring verifies the fix under realistic load. Documentation captures decisions and the rollback plan. Support teams receive a short note with symptoms and resolutions. The card moves to Low and stays visible for one Sprint. If no signals appear, close it with a brief summary. This discipline keeps confidence high and history useful.

Key Takeaway

Proactive risk management protects trust, clarity, and momentum. Identify threats together through structured brainstorming. Visualize them on a simple board with clear owners. Measure exposure with a burndown, and adjust calmly when trends drift. Integrate mitigation work into normal planning and coordination. Favor small, testable steps that ship quickly. With these habits, the budgeting app grows with fewer surprises, and users enjoy a stable, reliable companion for everyday money decisions.

Monitoring Progress

Why Monitoring Matters

Monitoring lets the team see reality early, and act before small issues grow. Our budgeting app handles private data and money choices. That makes transparency and fast feedback essential. We monitor during every Sprint, not just near releases. The aim is confidence, not control. When progress and risks are visible, stakeholders stay calm and aligned. Clear signals support better decisions. Everyone sees whether work reduces effort, reveals insight, or strengthens trust.

Monitoring During Sprints

Progress lives on a visible board with simple columns. To Do, In Progress, and Done. Stories move as tasks complete. The board reflects the truth of today, not yesterday’s plan. For Sprint One, spend capture stories should flow steadily. Quick-add, suggestions, and month view should move together. Stalls trigger fast conversations. The team inspects the board daily, trims work in progress, and unblocks issues quickly. Small batches keep momentum and clarity high.

Keeping the Board Honest

A board only helps when it is accurate. Update tasks the moment states change. Avoid holding cards for end-of-day batching. Link tasks to story acceptance criteria. Use concise titles that describe outcomes, not activities. For example, “Month view computes net position,” not “Work on calculations.” Close stale tasks or split them. Visual discipline prevents hidden queues. When the board reflects reality, downstream charts and forecasts become useful and trustworthy.

Updating Charts from the Board

The board feeds our Sprint charts. When a story hits Done, remaining points drop. The burndown updates, showing planned versus actual. Daily updates reduce surprises at the end. If the line flattens, investigate early. Maybe acceptance criteria are unclear, or dependencies block a path. The chart is a conversation starter, not a grading sheet. Treat it as shared instrumentation that keeps the team focused on the Sprint goal.

Choosing the Right Chart

Use simple visuals that match scope. A burndown tracks remaining points during a Sprint. A cumulative flow diagram shows work aging, and flags bottlenecks. A lightweight scorecard tracks velocity, predictability, and quality. For our initial budgeting slice, a burndown may be enough. Later, as imports and shared budgets arrive, add a cumulative flow diagram. Pick the fewest charts that illuminate flow, quality, and outcomes without adding reporting overhead.

Example: Burndown in Action

Assume Sprint One plans twenty-four points across capture and visibility. Day three shows the actual line above planned. Quick-add validation took longer than expected. The team swarms on validation and error handling. By day six, the line converges as stories finish. Month view totals drop the remainder. The visual made imbalance obvious. The team adapted calmly, without blame. The result was a usable slice that met our Sprint goal.

Measuring What Matters

Add outcome signals, not just output counts. Helpful indicators include, “First budget setup time,” and “Quick-add success rate.” Track “Dashboard load under two seconds,” and “Defects on critical paths.” These metrics describe user experience and trust, not activity. Keep metrics privacy safe and minimal. Show trends in the Sprint Review. When numbers drift, ask what changed. Then adjust scope, sequence, or design to protect the Sprint goal.

Making Risks Visible

Progress monitoring also covers exposure. Maintain a small risk board with High, Medium, and Low. Score each risk by impact and likelihood. Update a risk burndown alongside the Sprint burndown. Encryption tasks should drop exposure. Rollovers tests should drop it further. If new parsing issues appear, exposure rises, then falls after fixes. These visuals tell a simple story. They help leaders see where attention is most valuable next.

Roles and Cadence

Everyone participates in monitoring. The product owner checks value trends and scope health. Developers and designers keep the board current, and limit work in progress. The scrum master supports flow, and highlights bottlenecks. Quality specialists track coverage on critical paths. Use daily coordination for quick adjustments. Use the Review to explain progress with charts. Use the Retrospective to improve the signals, the board habits, and the definitions that guide work.

Key Takeaway

Monitoring is a lightweight habit that creates confidence. Keep a truthful board, update charts daily, and prefer simple visuals. Track outcome metrics that reflect user experience and trust. Show risk exposure clearly, and respond early. These practices turn planning into steady delivery. For a budgeting app, that means faster capture, clearer insights, and protected privacy. When progress is visible, decisions improve, and small wins compound into meaningful results.

Sprint and Release Retrospectives

Demonstrating Product Increments

At the end of each Sprint, the team shows a working increment. For our budgeting app, a meaningful increment might include quick-add expenses, a month view, and editable categories. The goal is usefulness, not perfection. Stakeholders see real screens and flows, and give practical feedback. Showing increments often builds trust. It also reduces surprises. Each demonstration connects planned outcomes to visible progress that people can try and understand.

What a Useful Increment Looks Like

A useful increment addresses a complete user path. A strong example is, “Create a budget, add two expenses, then see updated balances.” The flow should include realistic data. Edge cases are welcome if they are ready. Avoid partial features hidden behind toggles unless needed. If a feature remains incomplete, be transparent. Explain what is done, what remains, and why. Clarity keeps expectations healthy and decisions grounded in evidence.

Preparing for the Review

Preparation increases the value of the review. Choose scenarios that reflect the Sprint Goal. Use clear narratives, such as, “A family records groceries and transport, and checks the month total.” Keep the walk-through short, focused, and honest. Capture questions and observations live. Invite stakeholders to drive the app, not just watch. Hands-on exploration surfaces friction quickly. The review ends with shared understanding, not a surprise backlog of unplanned ideas.

Collecting Feedback That Matters

Good feedback connects to outcomes. Ask observers to judge usefulness, clarity, and effort. Encourage short statements, such as, “I could not find the category editor,” or, “Totals updated quickly and felt reassuring.” Group feedback into themes, like navigation, copy, speed, and trust. Note ideas that do not fit the current goal, then park them. Treat every comment with respect. The team uses these signals to refine scope and sequence.

Sprint Retrospective Purpose

After the review, the team reflects together. The retrospective focuses on how we worked, not only what we built. For our app, the team might celebrate a faster quick-add flow, yet note confusion in month view calculations. The group explores causes and patterns. The aim is improvement in the next Sprint. Small changes compound. The conversation stays blameless, specific, and practical. Everyone leaves with two or three clear experiments.

Simple Retrospective Structure